Approach

Datasets

- The TDAmeritrade API was resposnible for compiling basic finacial data for $AAPL and a number of comparative assests over the past 10 years including:

- Open

- Close

- High

- Low

- Volume

- Comparative Assets

- To accurately gauge and incorporate industry and macro trends, we have compiled the basic technical indicators of competitive companies and industry indexes. These included:

- $META

- $GOOGL

- $MSFT

- $AMZN

- $SP500

- To accurately gauge and incorporate industry and macro trends, we have compiled the basic technical indicators of competitive companies and industry indexes. These included:

- Tweets mentioning “$AAPL” and “AAPL” are scraped from Twitter.

- The dataset includes data from 05/09/2013 to 03/31/2023

Technical Analysis

Feature Creation

- Technical indicators are computed from our initial set of basic indicators (Open, Close, High, Low, and Volume). Some of the technical indicators computed are:

- Stochastic Oscillators

- Relative Strength Index

- Simple Moving Averages for Close and Volume

- Moving Average Convergence/Divergence

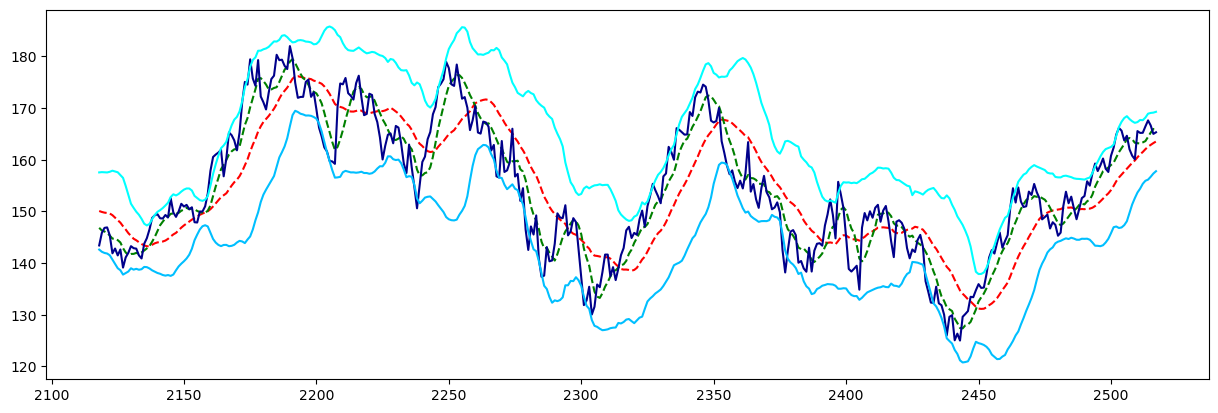

- Below demonstrates an example of the use of technical indicators over the last 400 days by showing the correlation of:

- SMA 7 (Green)

- SMA 21 (Red)

- Upper Band + Lower Band (Cyan)

- Closing Price of $AAPL (Dark Blue)

Feature Extraction

(Note: While attempted, autoencoding did not offer tangible model improvements)

- An autoencoder is used to produce a set of compressed features from the combination of basic and technical indicators.

- The compressed representation of the full technical indicator set is fed into the prediction model for training and forecasting purposes.

Fundamental Analysis

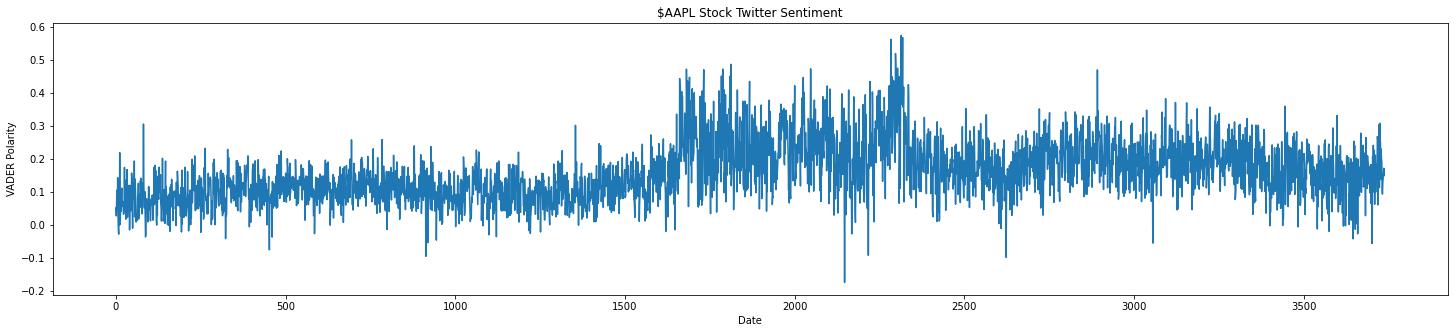

- The usage of sentiment analysis of data coming directly from the public (social media websites), rather than from biased news outlets or similar feeds.

- Text content from Twitter are web-scraped and processed via the NLTK library.

- VADER is used upon each media post to compute sentiment scores which are then averaged for any given day.

- A polarity score between -1 and 1 is assigned for average sentiment on a given day.

- Below demonstrates the recorded sentiment values of $AAPL stock over the duration of our dataset.

Prediction Model

- After feature engineering, our final set of compressed technical indicators is appended with the sentiment scores from the fundamental analysis and fed into a wGAN-GP model for training.

- wGAN-GP Model Description

- Wasserstein distance is used as a loss function for promotion of training stability.

- Gradient norm penalty is enforced in the discriminator in hopes of achieving Lipschitz continuity.

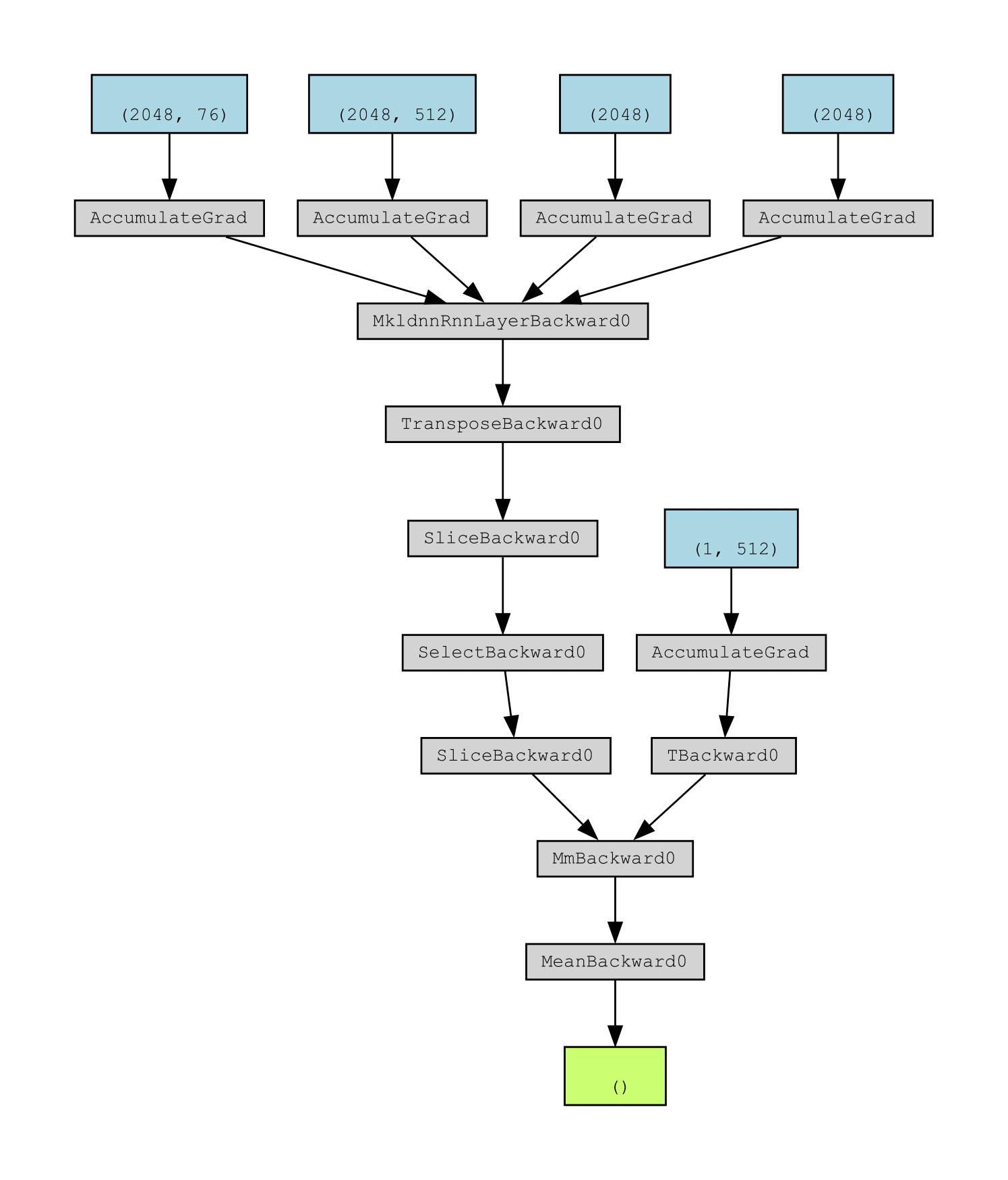

- Generator is an LSTM with input units equal to the final number of features and 512 hidden units, leading into a final linear layer with a single output for the closing price of each day.

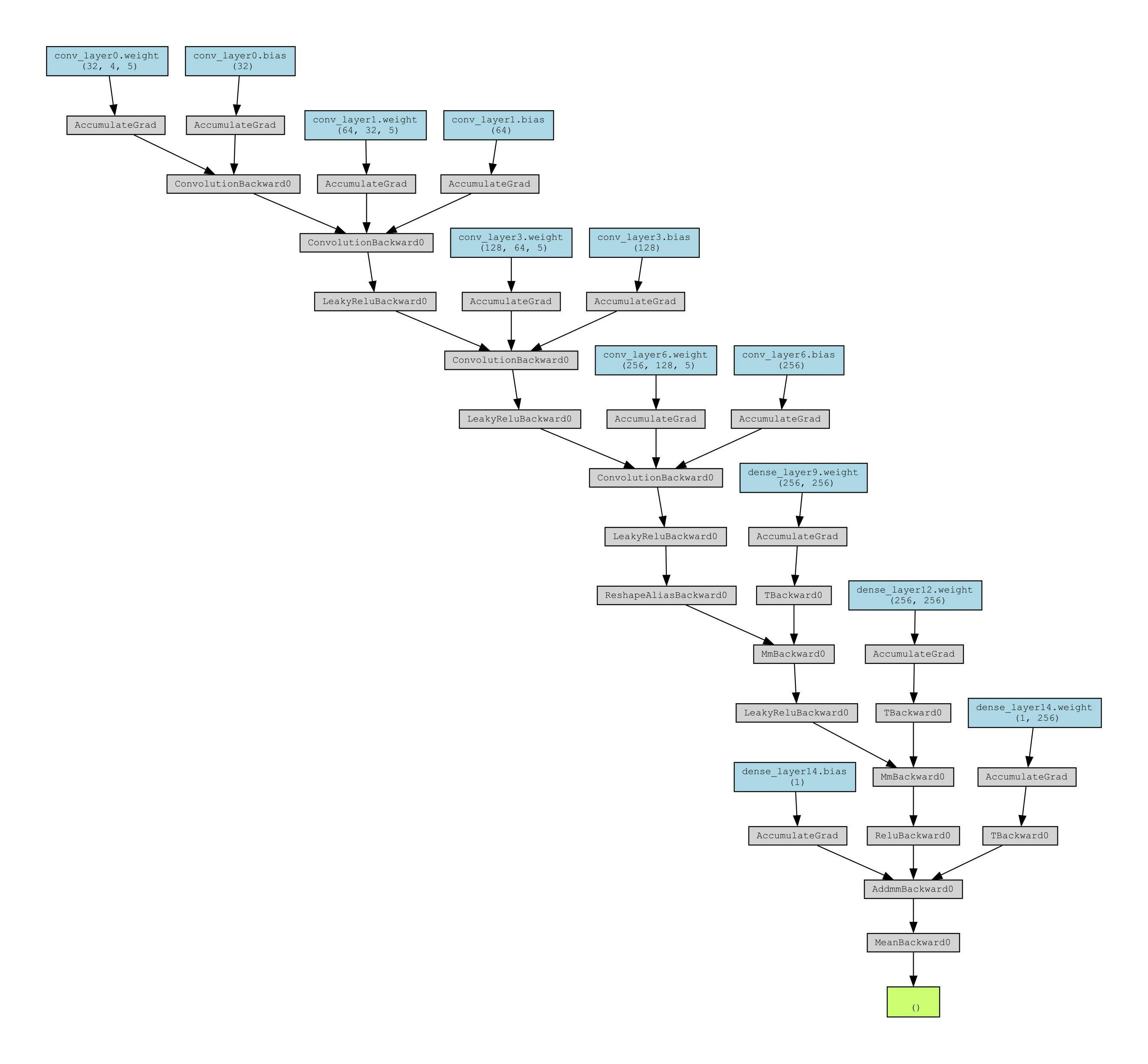

- Discriminator is a 13-Layer CNN composed of 1-D Convolutional, LeakyReLU, and Dense layers.

- Model is tuned with a predefined grid search.

Generator

Discriminator